Keir Starmer’s Labour government is celebrating a £150bn investment deal with the US:

Labour is backing British brilliance.

Major US investment flowing into clean energy, life sciences, and advanced manufacturing means more good, high quality jobs for people across the country.

— The Labour Party (@UKLabour) September 18, 2025

Not everyone is celebrating, however, with some describing the deal as a means for US companies to asset strip British wealth:

Beautifully put. It shows the madness at the heart of the UK’s economic plan. We do not need money from the US. This merely transfers ownership of assets to the US. The absolute worst approach for an economy that should instead be focusing on creating a resilient economy. pic.twitter.com/cOxs6f8B16

— William Thomson (@Williamgallus) September 18, 2025

Starmer meets vulture capitalism

Regarding Labour’s £150bn deal, the BBC has reported:

The vast majority of the £150bn investment – £90bn – will come from Blackstone over the next decade, although how most of this money will be spent has yet to be decided. The US private equity firm announced in June it would spend £370bn across Europe over 10 years.

As noted by openDemocracy, private equity firms like Blackstone are often referred to as ‘vulture capitalists’. These firms use cheap credit to buy businesses, giving them access to said business’s assets. This generally leads to mass layoffs and the sell-off of company resources, i.e. ‘asset stripping’.

In an article covering ‘vulture capitalism’, Peadar O’Cearnaigh wrote for the Canary:

Of course, the problem of vulture capitalism isn’t confined to Ireland. Their “predatory investment practices” have targeted several countries in financial difficulty. And before coronavirus (Covid-19) had spread across the globe, they’d amassed trillions of dollars in a “war chest” waiting for their next opportunity to exploit.

Companies such as Blackstone bought up homes in the US as families couldn’t afford to pay their mortgages. Additionally, austerity policies by right-wing European governments meant cities like Madrid sold off their social housing for next to nothing to these giants. And in the midst of the pandemic, companies such as Axa and QuadReal Property spent more than £1bn buying “more than 2,500 homes in the UK alone”.

In an article from July 2024, openDemocracy reported:

Labour’s frontbench team, including Siddiq, has met with City lobbyists on more than 20 occasions in the past year – not counting its significant engagement with the British Private Equity and Venture Capital Association, which openDemocracy revealed last month. BlackRock, Macquarie, HSBC, Bloomberg, Lloyds, Brookfield Asset Management and Blackstone are among firms to have secured access to leading members of the new government, including Starmer, Reeves, Reynolds and the chancellor of the Duchy of Lancaster, Pat McFadden.

The £150bn deal will include US tech companies. The involvement of these businesses has drawn additional criticism, especially as it’s commonly believed these companies are heavily over-valued, putting the world at risk of a Dotcom Bubble-type financial event:

It’s clear from the Windsor banquet guest list that the real purpose of Trump’s “historic” state visit is to invite US finance and tech CEOs to asset-strip anything here in the UK that isn’t nailed down pic.twitter.com/6b4IMwWTnI

— Nicholas Guyatt (@NicholasGuyatt) September 18, 2025

Those warning of a bubble include ChatGPT’s Sam Altman:

OMG — Sam Altman @sama just said the quiet part out loudhttps://t.co/FvhApPB9ON pic.twitter.com/Tbk9fZ4wIy

— Adam Taggart (@menlobear) August 18, 2025

A high price

Economist Richard J Murphy is one person who criticised Labour’s announcement:

Starmer saying we are (or, at least, he is) utterly dependent on the US. I might just have found a reason to say I want my country back. https://t.co/9eqCtIm9mA

— Richard Murphy (@RichardJMurphy) September 17, 2025

He also put this to Starmer:

You secured 7,600 jobs at a cost of £19.7 million per job with massive profit flows going straight back from the UK to US as a result. And you failed free speech whilst supporting a fascist, who you called your friend. The only question left to ask is why anyone might still vote…

— Richard Murphy (@RichardJMurphy) September 19, 2025

Murphy expanded on this at Funding the Future:

These must be the most expensively bought jobs in history.

Let’s put this in context. At the £37,000 median wage the return to the UK will be £281 million a year

Now suppose a rate of return of at least 8% on this investment, or £12,000 million (£12 billion)per annum.

Knock off the wages, and quintuple them for overheads and multipliers , and where is the remaining £10.5 billion or so going? Straight back to the US, I suspect.

Starmer has been well and truly shafted.

Those criticising the deal include Labour MP Clive Lewis:

Nothing screams “Mandelson-brokered deal” like auctioning off our values to BlackRock & Palantir for £150bn and a handshake with Trump.

If investment comes at the price of our values, it’s not a bargain.

It’s a bribe. pic.twitter.com/CNVwvm4c9f— Clive Lewis MP (@labourlewis) September 18, 2025

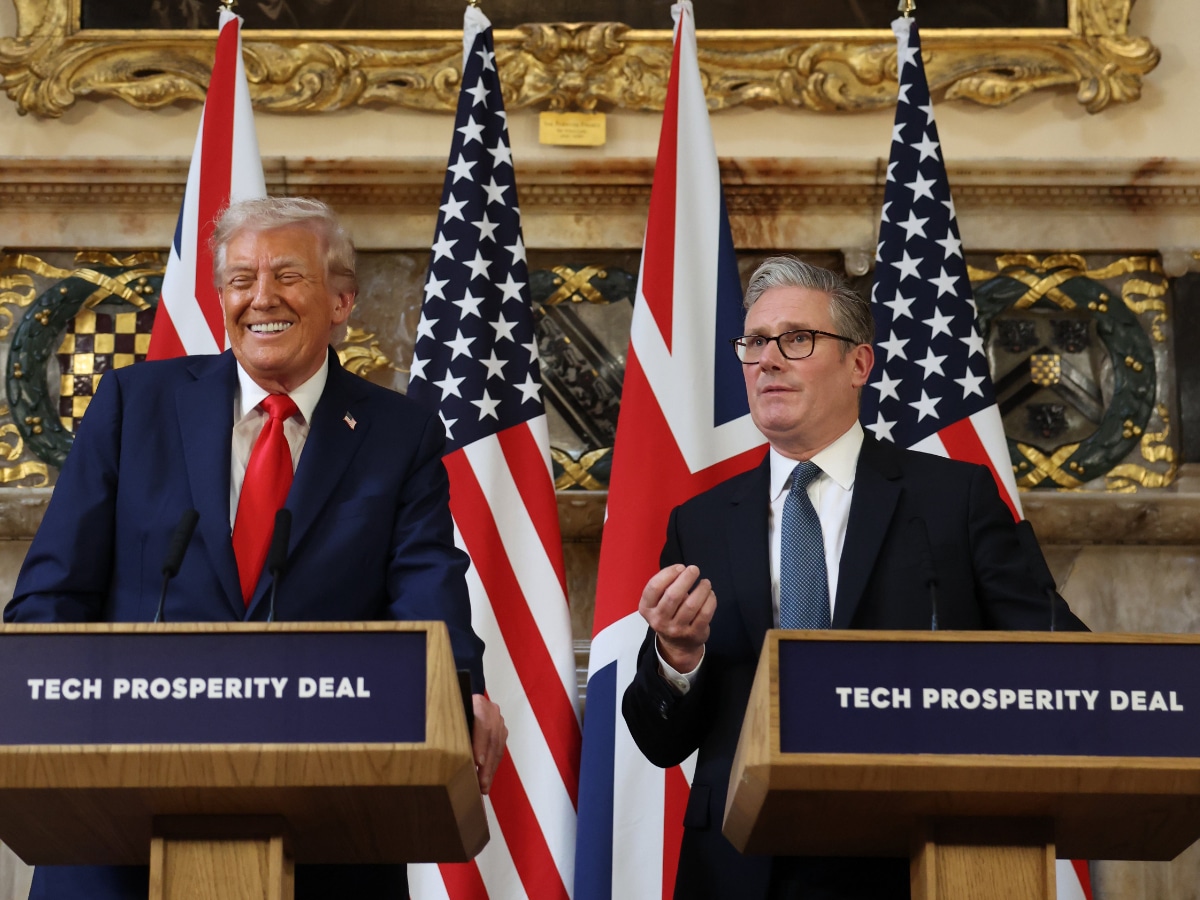

Featured image via Number 10